With recession conditions across the globe, the number of individuals with terrible credit increases day by day. With a blotchy credit background, you may face several obstacles, ranging from financial sanctions to having to rent rather than purchase a home. To qualify to rent a home, you’ll have to demonstrate that your bad credit score in no way disqualifies you as a good tenant. To pass muster and get that rental house, you should prepare yourself, and your own credit, beforehand.

Take steps to clean up your credit before searching for a rental house, and establish a listing of regular invoice payments. Get a copy of your credit reports and fix or dispute errors, then receive a copy of your credit scores from TransUnion, Equifax and Experian. A record of on-time payment for cable, phone and gas bills for three or more months can allow you to obtain a decent house to rent.

Search for a home that’s been in the leasing market for a long time, especially one at a not-so-popular locality or in need of renovation. Most frequently, the leasing terms are less stringent for such low-demand properties. Regardless of your bad credit, you’re going to have the ability to rent them readily.

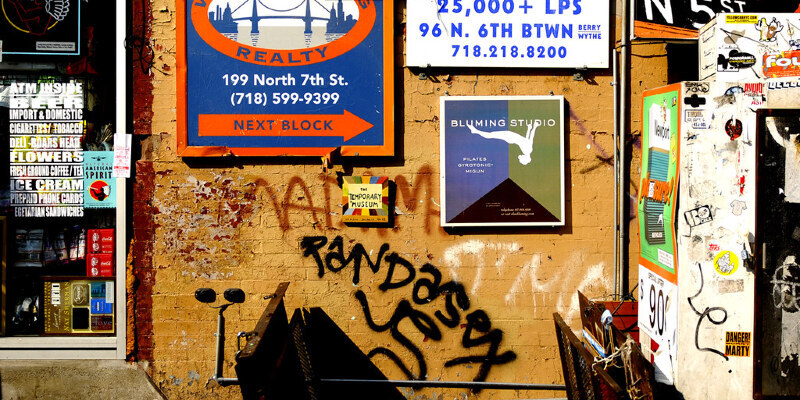

Find a landlord that doesn’t conduct a credit check. By bypassing a large management company and going private, you will have the ability to get a rented home on reasonable terms. The best places to obtain an owner-rented home are at the local newspaper classifieds and online classifieds.

Save up for a larger security deposit. Since a bad credit score leaves you a risky renter, the landlord may request a hefty security deposit. If not, you can provide the same in order to influence her opinion. However, some countries have statutory directions on the maximum payable deposit sum. In that case, you may pay the rent for a few months in advance.

Show good references when searching for the new rental house. If you are able to demonstrate a letter from the former landlord with good feedback about you, your bad credit may matter less. The letter must include the length of your stay from the home, your connection with other tenants and your rental payment track record.

Rent under your spouse or domestic partner’s name if he has a good credit score. Be aware that the landlord could still ask you to sign the lease. In that case, your credit will be checked, but your partner’s higher score may mitigate problems.